Unveiling the Landscape of Lebanon County: A Guide to Understanding the Tax Map

Related Articles: Unveiling the Landscape of Lebanon County: A Guide to Understanding the Tax Map

Introduction

With great pleasure, we will explore the intriguing topic related to Unveiling the Landscape of Lebanon County: A Guide to Understanding the Tax Map. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Unveiling the Landscape of Lebanon County: A Guide to Understanding the Tax Map

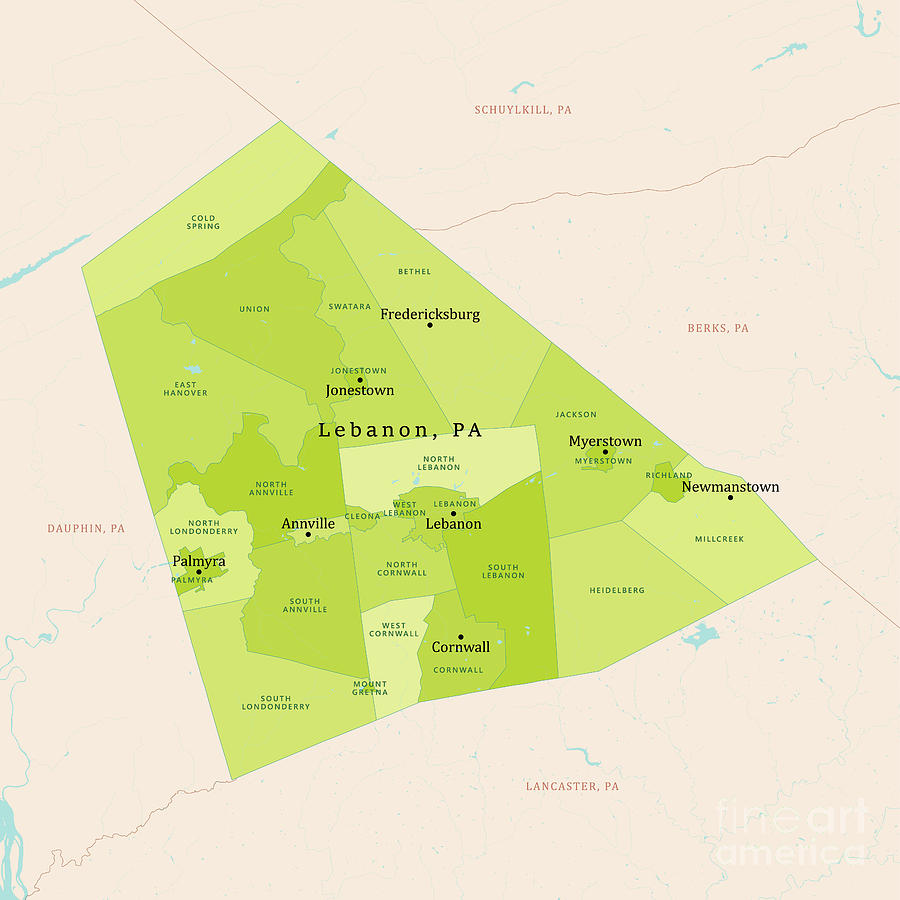

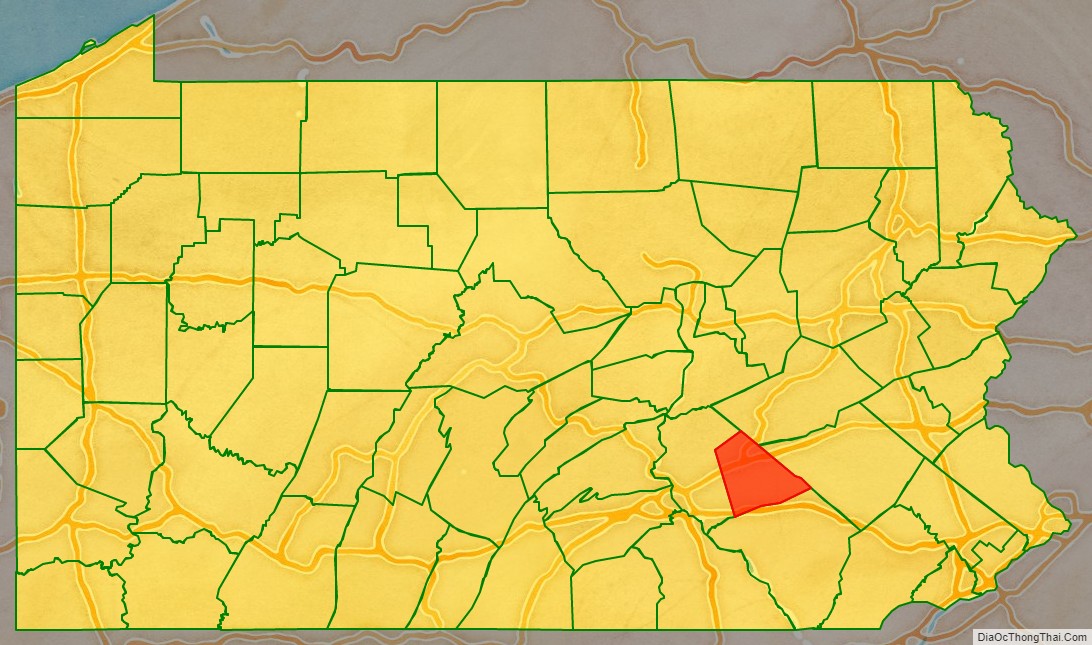

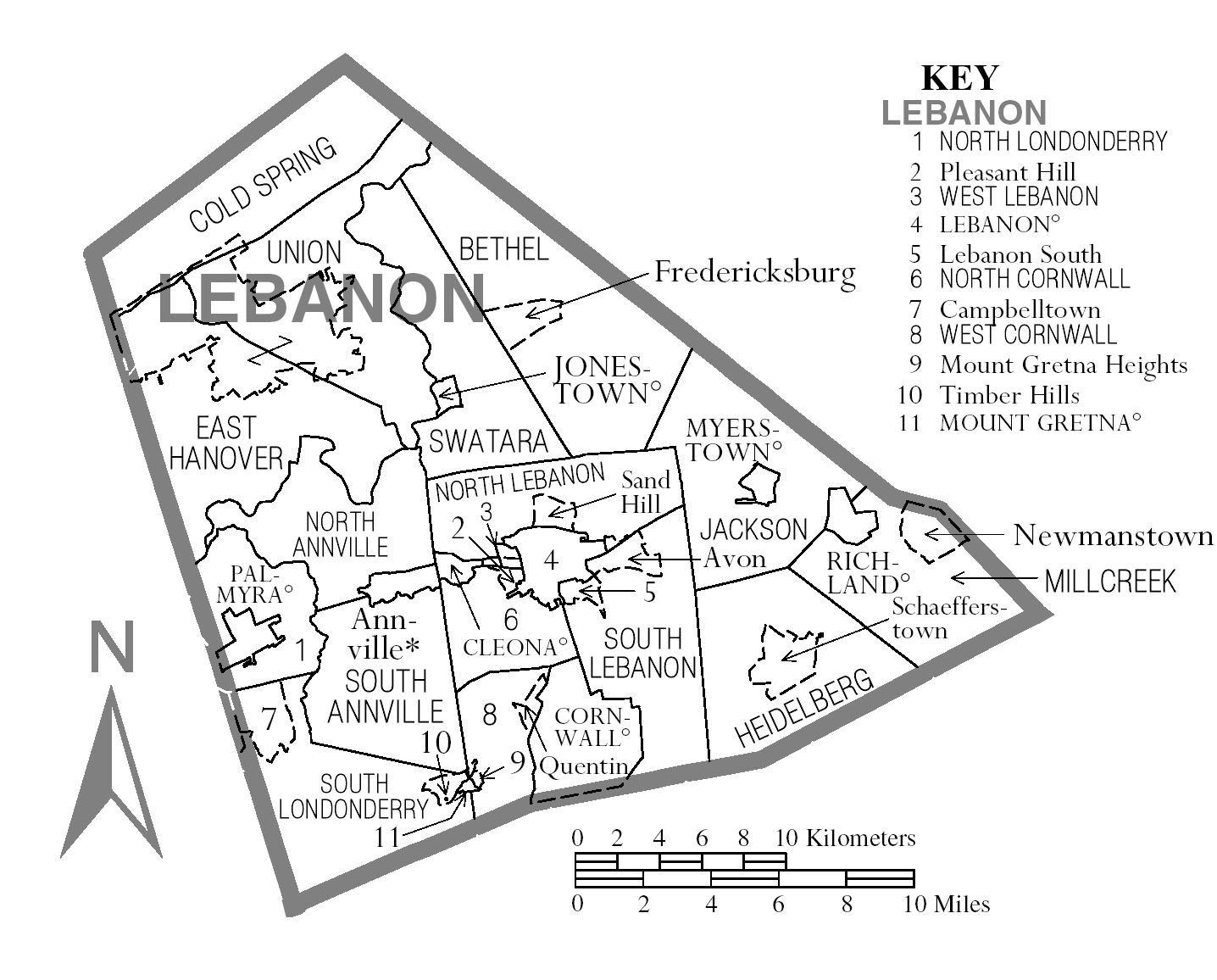

The Lebanon County Tax Map is an indispensable tool for navigating the intricate landscape of property ownership and taxation within the county. This comprehensive document, maintained by the Lebanon County Assessment Office, provides a visual representation of every parcel of land, encompassing its boundaries, ownership details, and associated tax information.

Delving into the Depth of the Lebanon County Tax Map:

The map is not merely a static visual; it serves as a dynamic database that allows for efficient access to crucial information. Each parcel is assigned a unique identification number, facilitating seamless retrieval of details such as:

- Property Address: Pinpointing the exact location of a property within the county.

- Owner Information: Providing details on the current owner, including their name and contact information.

- Property Classification: Categorizing the property type, whether residential, commercial, industrial, or agricultural.

- Assessed Value: Reflecting the estimated market value of the property, used for tax calculation purposes.

- Tax Rate: Indicating the specific tax rate applied to the property, determined by the county and local municipalities.

- Tax History: Accessing past tax payments and any outstanding balances.

Understanding the Significance of the Lebanon County Tax Map:

The Lebanon County Tax Map plays a pivotal role in various aspects of county operations, including:

- Property Assessment: The map serves as the foundation for property assessments, ensuring fairness and transparency in tax distribution.

- Tax Collection: It facilitates efficient tax collection by providing accurate property information and enabling the county to track payments.

- Land Development: The map is crucial for planning and development activities, providing insights into property ownership and potential land use restrictions.

- Emergency Response: It aids emergency responders in locating properties and understanding the surrounding environment during critical situations.

- Real Estate Transactions: It assists real estate professionals and individuals in conducting property research, verifying ownership, and determining property value.

Navigating the Lebanon County Tax Map: A User-Friendly Approach:

The Lebanon County Assessment Office offers multiple avenues for accessing and utilizing the tax map:

- Online Access: The office provides an interactive online map portal, enabling users to search for specific properties by address, parcel ID, or owner name.

- Public Records: The tax map is available for public inspection at the Assessment Office during regular business hours.

- Data Downloads: The office offers downloadable data files in various formats, allowing users to analyze and manipulate information according to their needs.

Frequently Asked Questions (FAQs) about the Lebanon County Tax Map:

Q: How do I find a specific property on the map?

A: The online portal allows users to search by address, parcel ID, or owner name. Alternatively, you can visit the Assessment Office for assistance.

Q: What information is included on the tax map?

A: The map displays property boundaries, ownership details, assessed value, tax rate, and other relevant information.

Q: How can I obtain a copy of the tax map?

A: You can access the map online or request a printed copy from the Assessment Office.

Q: How often is the tax map updated?

A: The map is updated regularly to reflect changes in property ownership, assessments, and other relevant information.

Q: What are the benefits of using the Lebanon County Tax Map?

A: The map facilitates property research, tax assessment, land development, emergency response, and real estate transactions.

Tips for Utilizing the Lebanon County Tax Map:

- Familiarize Yourself with the Online Portal: Explore the interactive features and search options available on the online map.

- Utilize the Search Functions: Utilize the address, parcel ID, or owner name search options to locate specific properties.

- Contact the Assessment Office: If you encounter any difficulties or have specific questions, contact the Assessment Office for assistance.

- Review the Property Details: Carefully examine the information displayed for each property, ensuring accuracy and completeness.

- Compare Data with Other Sources: Cross-reference information from the tax map with other sources, such as real estate listings or property records.

Conclusion:

The Lebanon County Tax Map stands as a testament to the county’s commitment to transparency, efficiency, and responsible governance. Its comprehensive nature and accessibility empower residents, businesses, and professionals with valuable information regarding property ownership, taxation, and land use within the county. By leveraging the diverse resources offered by the Assessment Office, users can unlock the potential of this powerful tool and navigate the complexities of property ownership and taxation with greater clarity and confidence.

Closure

Thus, we hope this article has provided valuable insights into Unveiling the Landscape of Lebanon County: A Guide to Understanding the Tax Map. We appreciate your attention to our article. See you in our next article!