Navigating the Tennessee Property Assessment Map: A Comprehensive Guide

Related Articles: Navigating the Tennessee Property Assessment Map: A Comprehensive Guide

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Tennessee Property Assessment Map: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Tennessee Property Assessment Map: A Comprehensive Guide

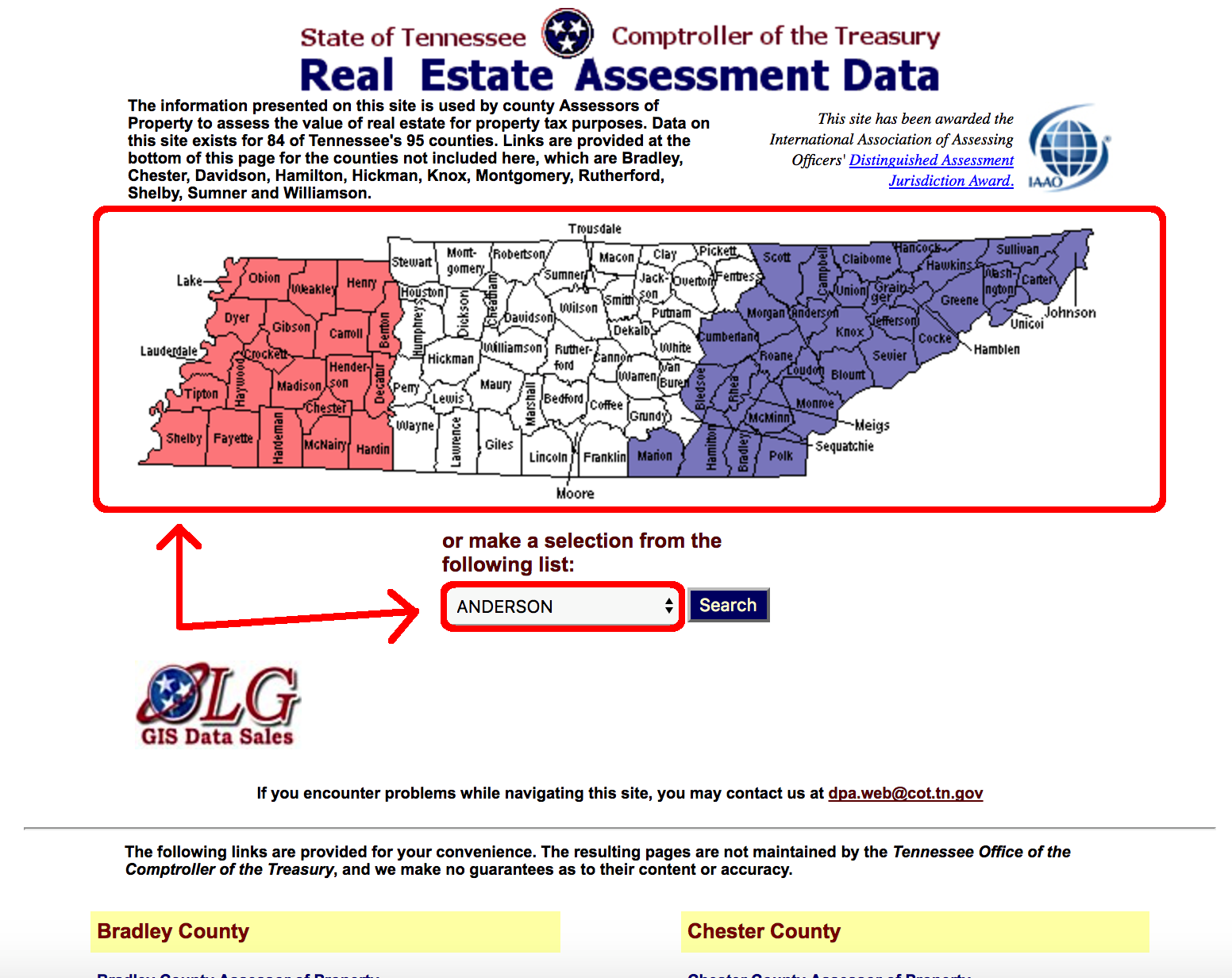

The Tennessee Property Assessment Map is an invaluable tool for anyone interested in understanding the real estate landscape of the state. This online resource, maintained by the Tennessee Department of Revenue, provides a detailed visual representation of property values across all counties. It serves as a critical resource for various stakeholders, including homeowners, real estate professionals, investors, and government agencies.

This article provides a comprehensive overview of the Tennessee Property Assessment Map, exploring its key features, benefits, and applications. We will delve into the data it displays, the methods used to generate the assessments, and the implications for property owners.

Understanding the Data Presented:

The Tennessee Property Assessment Map displays a wealth of information related to property values. Each parcel of land is represented visually, with its assessed value displayed directly on the map. This data is derived from the annual property assessment process conducted by county assessors.

Key Features of the Map:

- Interactive Interface: Users can zoom in and out, pan across the map, and navigate to specific areas of interest.

- Property Search: The map allows users to search for specific properties by address, parcel number, or owner name.

- Data Layers: Users can overlay various data layers, including property boundaries, zoning information, and sales history, to gain a more comprehensive view of the properties.

- Historical Data: In some cases, the map may provide access to historical property assessment data, allowing users to track changes in values over time.

Benefits of Using the Map:

The Tennessee Property Assessment Map offers numerous benefits to individuals and organizations:

- Homeowners: Property owners can use the map to understand the assessed value of their property and compare it to neighboring properties. This information can be helpful in challenging assessments, negotiating property taxes, or making informed decisions about selling or refinancing.

- Real Estate Professionals: Real estate agents and brokers can utilize the map to research property values, identify market trends, and analyze potential investment opportunities.

- Investors: Investors can use the map to identify undervalued properties, assess the potential for appreciation, and make informed investment decisions.

- Government Agencies: The map provides valuable data for planning and development purposes, including determining property tax revenues, allocating resources, and assessing the impact of new development projects.

How Assessments are Determined:

Property assessments in Tennessee are based on the fair market value of the property, which is defined as the price a willing buyer would pay for the property in an open market. County assessors use a variety of methods to determine fair market value, including:

- Sales Comparison Approach: This method analyzes recent sales of comparable properties in the area to estimate the value of the subject property.

- Cost Approach: This method calculates the cost of replacing the property, taking into account depreciation and other factors.

- Income Approach: This method estimates the property’s value based on its potential rental income.

Tax Implications of Property Assessments:

Property assessments in Tennessee form the basis for calculating property taxes. The assessed value of a property is multiplied by the county’s tax rate to determine the annual property tax liability. Property owners have the right to appeal their assessments if they believe they are inaccurate or unfair.

FAQs about the Tennessee Property Assessment Map:

1. How accurate are the property assessments displayed on the map?

The accuracy of the property assessments displayed on the map depends on the quality of the data used by the county assessors. While the assessors strive for accuracy, assessments may not always reflect the true market value of a property, particularly in rapidly changing markets.

2. Can I use the map to determine the sale price of a property?

The map displays assessed values, which are not necessarily equivalent to sale prices. The sale price of a property is determined by market forces, including supply and demand, and may be higher or lower than the assessed value.

3. How often are property assessments updated?

Property assessments are typically updated annually, although the frequency may vary depending on the county.

4. What if I believe my property assessment is incorrect?

If you believe your property assessment is incorrect, you have the right to appeal the assessment to the county board of equalization. The board will review your appeal and determine if the assessment should be adjusted.

5. How can I access the Tennessee Property Assessment Map?

The map is typically accessible through the website of the Tennessee Department of Revenue or the websites of individual counties.

Tips for Using the Tennessee Property Assessment Map:

- Understand the limitations of the data: Remember that assessed values are not necessarily equivalent to sale prices, and the map may not reflect all relevant factors affecting property values.

- Compare properties in the same neighborhood: When comparing property values, make sure to compare properties that are similar in terms of size, age, and amenities.

- Utilize additional resources: Combine the information from the map with other sources, such as real estate listings and market reports, to gain a more comprehensive understanding of property values.

- Consult with a real estate professional: If you have questions or concerns about property assessments, consult with a real estate agent or appraiser for professional advice.

Conclusion:

The Tennessee Property Assessment Map serves as a valuable resource for understanding the real estate landscape of the state. It provides a visual representation of property values, enabling homeowners, real estate professionals, investors, and government agencies to make informed decisions related to real estate. By understanding the data presented, the methods used to generate assessments, and the implications for property owners, users can leverage the map to their advantage.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Tennessee Property Assessment Map: A Comprehensive Guide. We appreciate your attention to our article. See you in our next article!