Navigating the Landscape of Otsego County: Understanding Tax Maps

Related Articles: Navigating the Landscape of Otsego County: Understanding Tax Maps

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Landscape of Otsego County: Understanding Tax Maps. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Landscape of Otsego County: Understanding Tax Maps

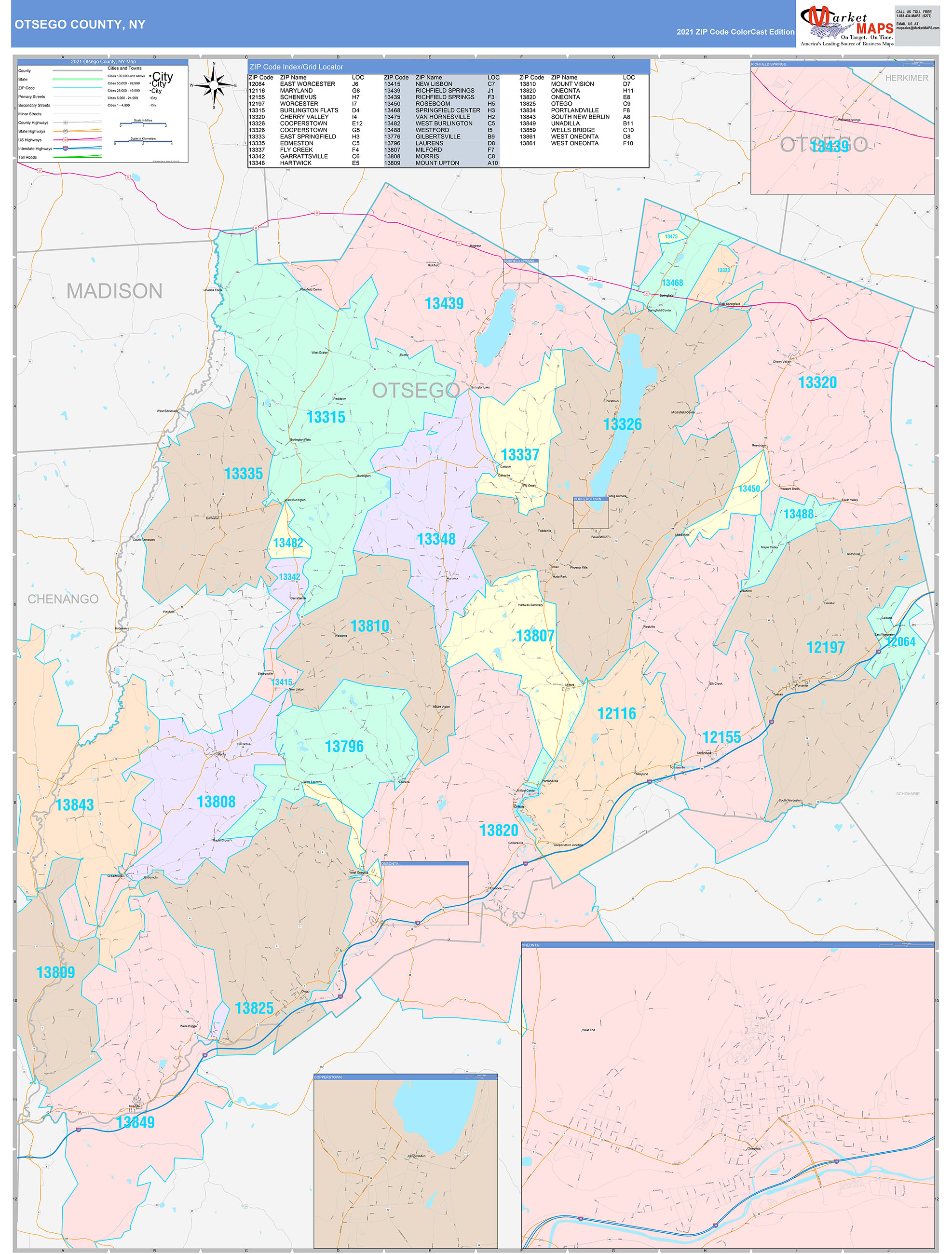

Otsego County, nestled in the heart of New York State, boasts a rich history and picturesque landscapes. This beauty extends beyond the rolling hills and sparkling lakes to its meticulously organized system of property records, known as tax maps. These maps serve as a vital tool for understanding the county’s land, its ownership, and its associated tax liabilities.

The Foundation of Property Management:

Tax maps are essentially detailed, geographically referenced diagrams that depict the county’s land parcels. They are a critical resource for various stakeholders, including:

- Property Owners: Tax maps provide a clear visual representation of their property boundaries, helping them understand their ownership rights and responsibilities.

- Real Estate Professionals: Real estate agents and brokers utilize tax maps to identify properties, assess their value, and guide clients in their property searches.

- Government Agencies: Tax maps are indispensable for assessing property taxes, managing land use, and planning for future development.

- Financial Institutions: Lenders rely on tax maps to verify property ownership and assess the security of their investments.

- Developers and Investors: Tax maps provide valuable insights into the availability of land, its zoning regulations, and potential development opportunities.

Dissecting the Data on Otsego County Tax Maps:

Each parcel on a tax map is assigned a unique identification number, often referred to as a "tax map number." This number is linked to a wealth of information, including:

- Parcel Boundaries: The exact dimensions and location of the property are clearly defined, eliminating any ambiguity regarding ownership.

- Property Ownership: The name and address of the property owner are recorded, ensuring accountability and transparency.

- Property Type: The map indicates whether the property is residential, commercial, industrial, or agricultural, providing context for its potential use.

- Zoning Regulations: The map identifies the specific zoning designation for each parcel, outlining the permitted uses and restrictions.

- Assessment Information: The assessed value of the property, which serves as the basis for calculating property taxes, is documented.

Accessing the Maps: A Gateway to Information:

Otsego County provides convenient access to its tax maps through various channels:

- Online Access: The county’s website often features an interactive map viewer, allowing users to explore specific areas and retrieve detailed information about individual parcels.

- Public Records Office: Residents can visit the county’s public records office to access printed copies of tax maps or request specific information.

- GIS Data: The county may offer downloadable Geographic Information System (GIS) data, enabling users to analyze and visualize the information in their own software.

Navigating the Complexity: Tips for Effective Use:

- Understanding the Legend: Familiarize yourself with the symbols and abbreviations used on the tax maps to ensure accurate interpretation.

- Using Search Functions: Online viewers often have search capabilities to easily locate specific properties by address, tax map number, or owner name.

- Requesting Assistance: If you encounter difficulties navigating the maps, don’t hesitate to contact the county’s assessor’s office or the public records office for assistance.

- Combining Data Sources: Tax maps are most effective when combined with other relevant data, such as aerial imagery, zoning ordinances, and property deeds.

FAQs: Addressing Common Queries:

Q: How can I find the tax map number for my property?

A: You can generally find your tax map number on your property tax bill, deed, or by searching the county’s online map viewer.

Q: What if the tax map information is incorrect?

A: If you believe the information on the tax map is inaccurate, contact the county assessor’s office to report the discrepancy.

Q: Can I use the tax map to determine the market value of a property?

A: While the assessed value is listed on the map, it does not reflect the current market value. Consult with a real estate professional for an accurate market appraisal.

Q: Are tax maps updated regularly?

A: Tax maps are typically updated annually to reflect changes in property ownership, boundaries, and assessments.

Conclusion: Empowering Understanding and Decision-Making:

Tax maps are more than just static diagrams; they are dynamic tools that provide a comprehensive overview of Otsego County’s land ownership and its associated legal and financial implications. By understanding the information they contain and utilizing them effectively, individuals, businesses, and government agencies can navigate the county’s landscape with clarity and confidence, fostering responsible land management and informed decision-making.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Landscape of Otsego County: Understanding Tax Maps. We appreciate your attention to our article. See you in our next article!